So you think you own some BitCoin. How do you know?

Even though brief news stories about BitCoin first began popping up in the widespread or mainstream media around 2012 (±1 year), say with Tesla Motor's announcement that you could buy one of their cars with BitCoin, the coverage started to expand exponentially not long after the 2016 U.S. presidential election and continued through 2017 -- with a corresponding decrease in the information content of such reportage.

This page is an attempt to remedy this problem -- some street smarts for the informaion super-highway, so you won't be roadkill.

In the stupidifying wasteland that is contemporary American media, I now hear entire hour radio talk shows devoted to the topic, from Nat'l Propaganda Radio to Glen Dreck, and a lot of it is some combination of hype, wonderment, and simple entertainment devoid of very much essential information, the latter always managing to get lost in the noise if it's touched on at all. This is almost always because the task of writing about BitCoin seems to fall on "tech" reporters, since it seems to involve computers, and nevermind that BitCoin is at least as much about money, and there are few experts in the theory of money extant --- books on the theory of money at a major well-known online retailer garner only handfuls of reviews -- much less those with expert knowledge of software and the new sub-speciality of digital money.

The first thing that gets lost in the shuffle is that BitCoin only exists in the universe of a peer-to-peer network. This is different from almost all of what is thought of as the I-Net, which is based on what's called client-server networking. The latter is actually quite similar to a radio or TV broadcast network in many ways, except that you and your browser (the client) can request a specific news story or whatever (a webpage), which the computer on the other end serves up to you, and maybe only you.

In client-server networks most of the information flow is in one direction. The client request is a small amount of information to transmit towards the server, and then the latter supplies the requested resource, typically in the form of computer file, an .htm or .html file (pages generated on the fly by "web apps" sometimes have other filename extensions). This is why that address at the top of your browser is usually relatively short, and why it's called a URL -- for Uniform Resource Locator.

Peer-to-peer networking is based on the idea that all the members (or nodes) on the network are equal in being able to both supply and consume resources. Maybe one peer has some resource that someone else wants, while another peer has something the first or some other peer wants. This is fundamentally different from the situation with client-server networking, which is more hierarchical; one person (the server) has a resource which the other (the client) wants, and the first has little or no need for anything the second has (at least in the way of computer files). The term "server" is somewhat of a misnomer here in the way we usually think of the word, which is in the opposite sense.

There is also a fundamental difference in the way resources are found on the two different kinds of networks. A client-server network lends itself to having everything indexed so that searches can find desired resources. On a peer-to-peer network, a resource may or may not exist somewhere, and the only way to find out is to ask every node on the network if they have it. Even if someone does, indexing can be of only limited benefit because that peer may drop off the network tomorrow, and there's no way to know in advance whether or when, if ever, they will return to the network. In the other direction, with resource sharing a given item may be found on only one node at one time but on many nodes a short time later. Trying to maintain a currently valid index of where everything is in semi-real time under such circumstances could easily come to occupy a substantial fraction of the network's activity. One of the nice features of the BitCoin network is that having every node in possession of basically the same resources obviates the need for any (or very much) indexing; you typically don't have to query very many peers to find what you're looking for.

Okay, so with that little primer on peer-to-peer networking behind us, I'll repeat what I said earlier about BitCoin only existing in the self-contained universe of the network of nodes.

It's important to realize that there is no other money in this universe.

Dollars, yen, pesos, whatever, live in an entirely separate universe. When

I'm connected to the BitCoin network, the screen only shows how many BitCoin

I have. It is not a currency trading plaform, or a transfer platform for

anything but BitCoin. Nobody needs "money" in the BitCoin universe because

BitCoin alone serves that purpose there, by definition.

I have. It is not a currency trading plaform, or a transfer platform for

anything but BitCoin. Nobody needs "money" in the BitCoin universe because

BitCoin alone serves that purpose there, by definition.

The interface between BitCoin and those other monies is not part of BitCoin. There are typically two kinds of such places, where the two universes make contact: the kiosks and the websites. The former are simpler. You put money in and a token or a piece of paper comes out saying you now own BitCoin. Kind of like a lottery ticket or an "investment" you stash away and then watch magically increase in value, because one doesn't get the impression that people who are stuffing bills into kiosks are doing so because they need BitCoin since it's the only way to buy something they want; there aren't too many things that the typical person can only buy with BitCoin, and no other way. This gets at the difference between an asset (or collectible) and currency in circulation, a distinction which is often over-looked in discussions of both/either. More on this later.

The token or piece of paper has a string of numbers and characters on it, giving it the appearance of being like a serial number on paper money. So someone might think it's a record that they own such-and-such a BitCoin, but BitCoin is not designated this way. It is described entirely by transfers: the blockchain ledger is not a list of which serial numbers belong to who, but a record of all the transfers from one node to another. If users employ BitCoin addresses only once (as recommended) each transaction is unique and it's not even possible to create, from the blockchain, a list of something like account numbers saying who owns which (how many) BitCoin.

So the question naturally arises: How do you know you own any BitCoin? How do you know the people behind the kiosk even own any BitCoin to sell you in the first place, or if they do how do you know they aren't selling them twice, to two different people (or worse)? You don't. You have to take their word for it. An important part of BitCoin is the "trust no one when it comes to money" ethic, so the kiosks are not part of BitCoin.

Actually there is a simple way to know if you own any BitCoin, and that is to check the BitCoin blockchain, which is where all the records of real BitCoin transactions are kept on the BitCoin network. The blockchain is just a massive accounting database -- 150 Gb in ~2200 files, and growing, as of this writing -- which keeps track of all the BitCoin and all the transactions between peers so that everyone knows, and agrees on, who owns what. Checking the BitCoin blockchain is a simple matter for anyone who's a node on the network -- it's so elementary that people in the BitCoin universe hardly ever bother to even check it, because doing so would be rather redundant -- but for those in the external universe this is somewhere between baffling and mysterious, and impossible to conceive how it would be done in any event:

It is possible to verify payments without running a full network node. A user only needs to keep a copy of the block headers of the longest proof-of-work chain, which he can get by querying network nodes until he's convinced he has the longest chain, and obtain the Merkle branch linking the transaction to the block it's timestamped in. He can't check the transaction for himself, but by linking it to a place in the chain, he can see that a network node has accepted it, and blocks added after it further confirm the network has accepted it.

- Section 8, Simplified Payment Verification, in the defining BitCoin "white paper"

Got that? If you're not doing this yourself then by definition you're outside the BitCoin universe by relying on some "trusted third party".

The other way to find out if kiosk BitCoin are real is to try transfering some to someone who is part of the BitCoin network. That is, to try buying something with them. Like authenticity. If they exist, a test sample can be sent, to, for example: 15vMKvMJqk9Ro4Sq5CVyRtozFRzmueMA9w -- the 34-byte receiving address on the BitCoin network for VISNS/BitCoin.

The websites advertising BitCoin for sale are not really fundamentally different from the kiosks in this important regard, though they look and act slightly differently. As part of the client-server universe, they look and act like many other sites: you "sign up for BitCoin" by getting a username and a password, with which you login to your account. After transferring monies to them via plastic card, PayPal, or bank account, they credit your account with so much money, which you can then use to buy BitCoin at some quoted exchange rate. Technical caveat: you cannot buy BitCoin with Paypal, due to the latter's policies. You first have to buy something else, like "gold credits", and then use those to buy BitCoin; i.e., you have to money launder PayPal money through something else to get it into BitCoin.

The complaint I've heard about the online BitCoin dealers, albeit in anonymous I-Net discussion forums, is that they kill you with fees both coming and going, at every step of the way. One person who went to buy something like $50 or $100 worth of BitCoin thought they ended up getting clipped for some 25-30% along the way. Presumably that would double when they went to go the other way, from BitCoin back to dollars. One would think such "transaction friction" would get eroded down and away over time through competition, in the way all fat margins are, but the websites don't always make it easy to find out in advance what they charge for their various services, and they may lower their commissions but make up for it by charging a slightly higher exchange rate. It's also further complicated by, say, PayPal also charging transfer fees on money coming in.

Be that as it may be, the same uncertainty as with kiosks remains. Your account may say you own some BitCoin, but how do you really know? Remember: The whole idea behind BitCoin is to do away with the need for any "trusted third parties". Because while you may trust them at first, before you know it they always seem to rig things so you have to trust them, no choice and like it or not, and just as you start to not trust them so much anymore.

Again, besides checking the BitCoin blockchain, the only way to find out if website BitCoin are real is to try transfering some to someone who is part of the BitCoin network. That is, to try buying something with them. Like authentication. If they exist, a test sample can be sent, to, for example: 15vMKvMJqk9Ro4Sq5CVyRtozFRzmueMA9w -- the 34-byte receiving address on the BitCoin network for VISNS/BitCoin.

The other obvious thing to wonder about the kiosks and websites is this: where did they go to buy BitCoin, and why can't I go there, too, just like they did, cutting out the middle-men and all their fees? If they have to pay the same sort of fees they're charging me, well, you don't want to be low down on the pyramid.

The reason this is germaine to the BitCoin universe is it begs the question of exactly how BitCoin gets out of one universe and into the other. One of the things never mentioned in discussions of "how BitCoin works" is that peers on the BitCoin network can not only initiate a Send command to any other node on the network, but one can also Request a transfer from any other node. This is kind of like the difference between paying as you "checkout" (before) and being sent an invoice that you respond to (after).

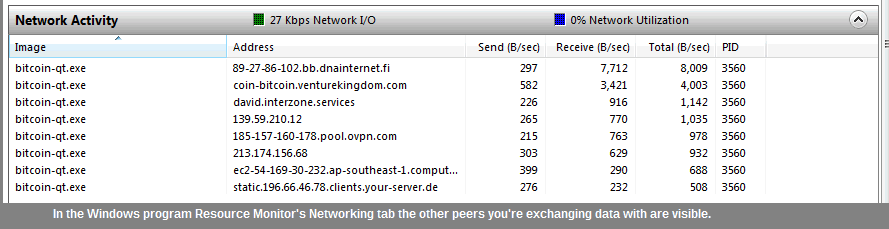

All of the nodes on the network are visible to all other nodes at any given time. My peers.dat file, which contains information on all the peers who have ever been on the BitCoin network at the same time as I have, is currently 4.1 Mb, 62 bytes per entry (=> 69,300 peers), so the data necessary to send a request is right there for anyone on the network to access and use.

Note that hardly 20 kilobits per second bandwidth is needed

on the BitCoin network, and much of the time only ~10% this much.

As one of only some 13,000+ total nodes on the network -- at last count, and so they say (I haven't counted them), and remember that not all of these are necessarily on the BitCoin network at any given time -- I can tell you I've never received such a request for a transfer with an offer of money, the BitCoin network equivalent of spam. This is not what one would expect given the bubble and craze nature of BitCoin as of late. You'd think people would be beating the bush to get all the BitCoin out of it they could, trying to find anyone and everyone who had any. But that's evidently not happening. Why?

Not that I'm complaining about not getting any such spam. It's not clear in any event how an outbreak of request spam could be suppressed, so that it doesn't swamp the network (like requests for indexing information can be in a generic peer-to-peer network). My banlist.dat file is only 37 bytes, so it evidently doesn't contain a list of all those who have been banned, but instead just apparently denotes whether the particular instance of the networking program being run has itself been banned (turned OFF). I haven't looked at the source code, so I'm not sure how all this is managed; my copy of the file dates to when the program was installed on my machine, and it hasn't been modified since then, so my guess would be that it's merely checked on program startup but otherwise isn't used.

Besides that, it's also not clear what such a request and subsequent transaction would look like. Would I just be expected to transfer my BitCoin to some anonymous digital address because someone says they'll send me so much money after I do so? What kind of idiot would reply "Okay, here you go."?

The question is somewhat like asking what happens if one messes up the 34-byte Send To address of a transfer, by even one character. There are no do-overs, nor any "Customer Service" number to call, or any way to reverse the transfer, or even find out where it went, and the BitCoin effectively just vanishes so far as the sender is concerned -- while someone entirely else gets the BitCoin out of nowhere and for no reason, like manna from the BitCoin Fairy. Fleecing people with a bogus promise of money if they'd send you their BitCoin would be about the same thing from the standpoint of the sender.

So how about I say I'll send them the BitCoin after they send me the money? The same uncertainty arises, only in the other direction. The money arrives in my PayPal or other non-BitCoin universe account, I cash that out before closing it and then just vanish, stiffing them on the BitCoin. I could always say the check, so to speak, was in the mail. After they give up waiting, how much would it cost to try and track me down? Have I even entered into a legally binding contract that someone could or would enforce, when communication involves a couple of electronic communications and imaginary, digital "money"? Let's say I've already spent all the money AND my BitCoin; how are they going to recover anything? I've thought about this some because I've expected to receive money-for-BitCoin requests out the wazzo, and out of the blue, but like I say I haven't gotten any. Where are the supposed BitCoin dealers getting their BitCoin from anyway?

Of course the technical answer is that all one has to do is look in the blockchain to find out where a BitCoin came from, and you could backtrack it all the way to maybe the "Genesis Block" (block #0), but this doesn't really tell you what you want to know because of the anonymity of the peers on the BitCoin network.

The number we're ultimately looking for here is analogous to what in the stock market is called the "float" or, for currencies, the "money supply" (which is more complicated). If a company is formed with a total of 100 shares, but only 80 of these are sold off at the Initial Public Offering (IPO), then the float is 80 shares. The other 20 shares may belong to the company, the company's founders, and/or the investment bankers who engineered the IPO; and there may or may not be restrictions on those shares being sold sometimes in the future -- and thus adding to the float, which increases the supply, changing the supply-demand equation and thus the price. (Share buy-backs do the opposite, reducing the float.) For BitCoin, the float is not the total number of BitCoin created within the network so far, but the number that have in some sense leaked out and are in circulation in the outside unverse.

In the BitCoin universe, in addition, and according to one source, there are already four million homeless or dead (MIA?) BitCoin, where the owner's wallet -- a vital wallet.dat file -- has supposedly been lost, not backed up sufficiently. So the BitCoin exist in the blockchain but will never be transfered again because the user's key is forever gone (BBC, 9 Dec 2017). These would include an unknown number of BitCoin wallets on stolen devices, where it is presumed the new "owner" doesn't know they are there, doesn't know how to access and recover them, and/or erases them in the process of clearing the device's storage and memory for re-sale as a "like new" device. (People don't typically steal computers, tablets, or phones for their own use, because they want one for themselves, but to convert them into cash by selling them to someone else.)

That aside, another, entirely different way of looking at all this

would be to say there has been no BitCoin IPO, so there is no float,

and BitCoin will forever be in what would be called "closely held

hands", contained in its own peer-to-peer networking universe. This

would mean the only thing trading in the wider universe now is "paper

BitCoin". This might be somewhat analogous to "when issued" (WI)

warrants in the stock market, which allow a stock to trade in the

open market before it's actual IPO in some instances, the

difference being that there are rules in the stock market to make

sure the warrants actually represent something of value -- shares

of the stock after the IPO happens. And, of course, there will never

be anything except these BitCoin WI warrant equivalents, since there

will never be any BitCoin IPO. As BitCoin has soared in currency

price, there has been a proliferation of other crypto-currencies

and their ICO's,

Initial Coin Offerings,

for which this discussion is also generally relevant.

In technical parlance, all the "owners" of paper BitCoin are short X amount of BitCoin. The best way to understand short selling is by way of something my WWII B-24 pilot dad once mentioned, the Kansas City Stock Exchange. This was not much more than a small-medium sized office with several clerks, a stock ticker connected to New York City, and a chalkboard. Runners would go back and forth between the ticker and the board, updating the prices with an eraser and piece of chalk as they came over the ticker. In front of the board was a wooden bench, where one could usually find a few retired businessmen watching the action while trading war stories about their glory days in business.

Let's imagine two of them, named Freddy Ford and GM Joe for their staunch partisan approach to the car industry. They might own a small number of shares of their respective favored companies, because way back then GM shares, for example, came with a 5½% dividend whereas the bank only paid 4½% on savings. After saving up several hundreds or a thousand of dollars it would make sense to buy 15 or 25 shares of stock.

One day, Ford makes the big announcement about the release date a little in the future of their great new offering, the Edsel. Freddy and Joe are having one of their usual heated arguments and disagreements about the industry, it's future, etc., and the latter is trying to convince the former that all the hype about the Edsel is more than Ford can possibly ever deliver on, and that he should sell his shares. Being a diehard, he refuses. So GM Joe says "well then, loan me the shares so I can sell them!".

This is the essence of short selling, selling something you don't own. The important point is that it involves a loan denominated in shares, not their value in dollars. At some point in the future the sold or shorted shares will have to be bought back in the market (called "covering a short") and returned to Freddy Ford. GM Joe doesn't get to simply pocket the money from selling Freddy's shares and do what he wants with it. In fact, the money needs to be set aside as collateral for the loan, to insure that the shares can be bought back in the future. Joe is anticipating that the shares' price will drop and he'll be able to buy them back sometime in the future at a lower price than he sold them for and return them to Freddy, who is then none the worse off. Joe's resulting profit is the difference in share price from when they were sold to when they were bought back times the number of shares (minus commissions).

If the price of a stock which has been shorted goes the wrong way (for the short seller) for whatever reason, that is if it goes up, then the money received from its sale no longer serves as sufficient collateral. The short seller (Joe) then either has to add his own cash to it, or, if he's either unwilling or unable to do so, the position is closed out -- meaning the collateral money held in reserve is used to buy back the borrowed shares in the open market and these are returned to Freddy.

It's also important to notice the risk asymmetry between buying and owning a stock, and short selling it. In the first case all one can lose is ones entire investment, if the company goes bankrupt. In the case of short selling, however, a stock can double or triple, or more, from the price it was sold at, so the risk is unlimited. In other words, a stock can only go to zero but can go all the way up to infinity (effectively). So a short seller needs to be good at managing positions that are going the wrong way since it's impossible to be 100% right and time things perfectly; many positions will go the wrong way before going the right way (or not), so some "draw down" is inevitable.

In defense of short selling, stocks usually go down faster than

they go up, so rates of return can be higher. Short selling can

also be argued to be good for markets overall, since one can sell

any stock, not just ones one owns. This keeps markets honest, in

a certain sense. Short selling responds to increasing share prices

by effectively increasing the number of shares in the market, the

float. In prinicple this force acts in the direction of driving

the price back down, so short selling reduces volatility, and

stocks running up endlessly with "irrational exuberance".

any stock, not just ones one owns. This keeps markets honest, in

a certain sense. Short selling responds to increasing share prices

by effectively increasing the number of shares in the market, the

float. In prinicple this force acts in the direction of driving

the price back down, so short selling reduces volatility, and

stocks running up endlessly with "irrational exuberance".

People buying a stock, especially a hot one (that is, one you should have bought a year or more ago when it was much cheaper), should probably first consider that the person on the other side of the trade, the person selling them the stock, may be a short seller. The anonymity of trading stocks via brokers and an exchange means you can't know one way or the other. The stock market does keep track of, and report on a monthly basis, the total number of shorted shares outstanding in a particular company, the so-called short interest. "Interest" is an appropriate term because at some point in the future the short sellers will all have to buy back their shares to repay the loan, and they thus represent a reservoir of compulsory, not just voluntary, buyers. The signature that they are doing so is a market rising on decreasing (not increasing, as would be usually expected) short interest, a "short covering rally".

This lengthy seeming digression on short selling stocks is relevant to BitCoin because my strong suspicion is it's precisely what's behind the dollar currency value of BitCoin going up ~10x in the last year. Obviously the relevant data needed to build an airtight logical case for this supposition is unavailable. We don't know BitCoin's float, or how much of it is paper BitCoin that has been created out of thin air and then sold short -- in the outside universe, where there's no requirement for anyone to put up or maintain any collateral. It's not possible to short BitCoin within the peer-to-peer network, which would amount to creating a negative balance; i.e., you can't transfer BitCoin there that you don't have in the first place.

There's no provision built into BitCoin allowing it to be loaned.

A transfer is a transfer, with no other strings attached, and when the

transaction is completed by incorporation into the blockchain that's

the end of it. Since the nodes are both anonymous and potentially

temporary, there's no mechanism within BitCoin for securing a loan

to make sure it will ever be paid back. There's also no way to

incentivize such loans in the first place, that is to have a rate

of interest return or other cost on the loan. You might give your

buddy outside the BitCoin universe a no-interest, short term loan,

but in the rest of the world people usually need something to make

up for the potential headache of taking on the risk of maybe not

ever being paid back. It would take an entirely 'nuther, parallel

blockchain to implement all that into BitCoin.

blockchain to implement all that into BitCoin.

One obvious implication of all this is also that a stash of BitCoin doesn't earn interest or pay a dividend. AKA, it's "dead money", more like other collectibles, gold or art, say. The only reason for holding it rather than something else, beside the fact that you like it, is the hope or expectation of future price appreciation. This raises the somewhat orthogonal question of "were it not for $$'s or other currencies, what attention would BitCoin garner?"

So how would short selling paper BitCoin work in practice? Let's say

someone who owns no BitCoin whatsoever sold 100 paper BitCoin a year

ago to somebody at $1000, accumulating $100,000 in the process. The

short sale is then an internal accounting matter. Unlike in the stock

market, there's no requirement that the cash collected be held as

collateral to cover the short position later. So long as everyone

who bought just stashes their lottery ticket away in the drawer for

a long time there's no problem. One of the reasons Wall Street is

always pushing the "buy and hold" approach to stocks on the public

is because they are basically in the business of printing paper

(share certificates), selling it, and then trying to convince the

buyers to act in Wall Street's best interests by taking these shares

out of circulation for as long a time as possible, ideally forever.

who bought just stashes their lottery ticket away in the drawer for

a long time there's no problem. One of the reasons Wall Street is

always pushing the "buy and hold" approach to stocks on the public

is because they are basically in the business of printing paper

(share certificates), selling it, and then trying to convince the

buyers to act in Wall Street's best interests by taking these shares

out of circulation for as long a time as possible, ideally forever.

So let's say only 5% of the people who bought the BitCoin try to use it to buy something. The short seller has to go into the open market and buy these BitCoin before they can be transfered over the BitCoin network. If the currency value has doubled in the interim, let's suppose, then the short seller of the paper BitCoin has to buy 5 BitCoin at $2000 each, for a total of $10,000. Their initial $100,000 take drops to $90,000, but otherwise everything is still okay. And so on. Even if the currency value of BitCoin goes up 10x, so long as the percentage of people trying to cash their's in or spend them remains sufficiently small, the strategy can work and make money for the paper BitCoin short seller, and the game continues. When it collapses, the first ones out the door get something, but most get wiped out and end up holding "the bag" -- worthless fake BitCoin in this case.

The gist here is that you may not own any BitCoin until you go to transfer ("spend") it. That's when the paper BitCoin short seller has to cover your (his) position.

Let me be clear. I'm not accusing anyone and everyone in the BitCoin to currency trading market(s) of doing this. There are likely legit operations selling real BitCoin that they own, or that they buy not long after selling them to you, say. The problem is that there's currently no real way to tell who they are or how much of the market they represent. So I won't diss or endorse anyone in particular.

One of the reasons for companies issuing publicly traded stock shares, even just as penny stocks, used to be because of the uniform if somewhat minimal transparency requirements for doing so. Because of the nearly infinite risk to short sellers, those who manage their trading poorly are quickly wiped out and removed from the marketplace, not that others might not come in and replace them; as the currency price of BitCoin rises ever higher, the incentives for selling paper BitCoin short out of nothing but thin air increase along with it. If a given paper BitCoin short seller starts to run out of cash, they can always raise more by shorting more BitCoin, in a sort of pyramid scheme whereby the later buyers are used to pay off some of the earlier ones.

I won't even admonish everyone to "do your own research", since this basically amounts to going out on the I-Net and reading a bunch of opinions written by who-knows-who, most all of which are dedicated to making you feel okay with parting with your $$'s for something very abstract and intangible. Remember: "Investing", like collecting, is the removal of manufactured paper (or something) from circulation. The people who constantly conflate investing with circulating money (currency) are probably the people who should be ignored the most, since they typically take both sides alternately. "Yes, you should buy some BitCoin as an investment because it's going to be the circulating money of the future -- but if not it will crash, though people should take the risk anyway, just in case, but only with money you can afford to lose.". There are probably better things one can do with such money.

Short covering rallies are notoriously sharp and short, in the stock market at least, with wicked whipsaw jumps and pull-backs. Buying the sharp pull-backs works -- until it doesn't. Once the compulsory buyers are exhausted, the price then collapses, driving out many of the longs in the process.

Real bull markets typically "climb a wall of worry", meaning they grind slowly but relentlessly higher against a lot of doubt and healthy skepticism. Since BitCoin represents an entirely novel experiment, we don't know now exactly how much of what we know about markets in general applies, or exactly how, though it's likely to be more than the hype suggests. A hallmark of market manias is the mantra "...but it's really different this time".

Talk of BitCoin being the perfect "bubble currency" goes back at least some 4 years -- because, for one thing, one could only "go long", since shorting it within the BitCoin universe was not possible -- when you could have gotten it for $100 or less, which still seemed like a lot since there wasn't anything most people could do with it that they couldn't do with other money. So at least things have played out about as expected so far by many of those who looked into it back then.

There's another, entirely different possibility from the above...

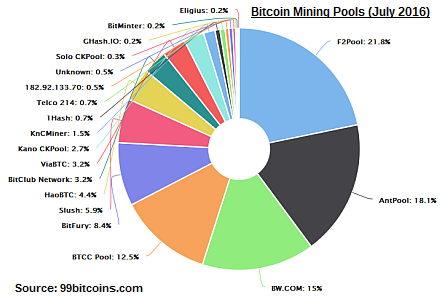

The price increase could be the result of a

self-organizing assemblage of several or all of the Big

BitCoin™ mining interests, who actually have some BitCoin, but

just trade them back-and-forth largely between themselves at ever

increasing prices. In game theory and economics, where this is

sometimes called "catallaxy", this herd behavior or groupthink

would, at least in the short run, be to everyone's advantage to

participate in, a way of inflating the value of everyone's assets

equally without any actual collusion. Just follow the rule: "pay

more today than you did yesterday".

equally without any actual collusion. Just follow the rule: "pay

more today than you did yesterday".

It then takes very little outside money coming in, in a thinly traded market -- BitCoin maxes out at only about seven transfers per second being possible -- to support the price advance, even if the inward money flow only approximately matches the rate at which BitCoin are produced and mined. The one difference between BitCoin mining and real-world mining is that in the former success is assured for someone with each new block in the chain.

Right now I know of no way to distinguish between these two possibilities, which are not mutually exclusive, and neither may be true.

So what is an astrophysicist's interest in all this? It has to do with cryptography, or, rather, it's opposite. But I'm not talking about decryptography per se. Instead, my interest in it is interstellar communication using radio (or light) waves, and the associated search for extra-terrestrial intelligence (SETI). Let me try to explain.

Cryptography is about scrambling information, but in such a way that it can be recovered by someone knowing exactly how it was scrambled (encrypted). In this sense it bears a similarity to data compression methods frequently used in the digital imaging field, and, more particularly, the class of these known as 'lossless' compression. (Jpg and mpeg are, for example, 'lossy' methods, since they achieve compression partly by disgarding some of the information, which is then not recoverable, meaning the decompressed image is different from the original, but in a way which is not very visible.) The process of decryption is analogous to decompression, recovering the original image data. In the absence of the decryption or decompression recipe, one is left shooting in the dark via trial and error to try and find the one originally applied to the data.

The problem of interstellar messaging is the opposite of this, since it is the attempt to encode information in such a way that it's understandable and interpretable to anyone who might receive it, beyond the mere fact that it was produced by 'intelligence' -- distinguishable from natural processes that also produce electromagnetic radiation.

Some doubt whether it's possible to create a language or method of encoding a signal that is universally easily recognizable and understandable. But I suppose the point here is that the idea is to make a data stream which has the least amount of inherent encryption in it to start with, as opposed to the most (within practical limits). Another way of saying this is to refer to the use of much cryptography in the cause of making information as private (secure) as possible, whereas the problem of interstellar messaging is in making it as public as possible, requiring the least amount of decryption or decompression (or subjective interpretation) on the part of the receiver.

As far as what Deavours said, the first part -- the recognition of a signal as alien -- is entirely in the hands of the observers. This is because the volume of data generated is beyond the ability to store it all, for careful analysis later (the way astronomers usually work), so it is screened in realtime and only a small amount (~1-2%) is flagged by saving it. One hopes the baby isn't thrown out with the bath water static at this first stage, that the selection criteria isn't too biased. The cryptographic challenge is to test for the presence of information, to make sure it's not just random noise.

The second part, is, of course, potentially more interesting, which no doubt explains why it's received so much more attention. What happens if we get a signal that everyone agrees is bona fide of extraterrestrial origin but that is completely unintelligible, defying all analysis? Once it's stumped the experts who get the first crack at it, one presumes it would be released to the public, if only because the announcement of its detection would make everyone both be curious and want proof by seeing the "message". Or at least that's the protocol based on what international agreements there are. With more people interested in cryptography there's a greater chance that the information can be extracted, on the assumption that many, many heads are better than (just) many heads.

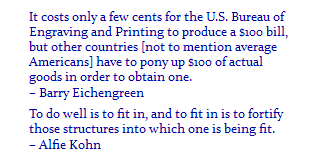

Gresham's Law, the economic basis for BitCoin, and it's current mining production cost (March 2018)

Eichengreen is an economics professor and Establishment dinosaur who's been

at the Int'l Monetary Fund (IMF), the Council on Foreign Relations (CFR) ALIGN=RIGHT,

and believes in theory in a global central bank and a global currency, and

he doesn't address digital currencies at all -- but you can learn lots from

studying the dinosaurs' vanished way of life.

Eichengreen is an economics professor and Establishment dinosaur who's been

at the Int'l Monetary Fund (IMF), the Council on Foreign Relations (CFR) ALIGN=RIGHT,

and believes in theory in a global central bank and a global currency, and

he doesn't address digital currencies at all -- but you can learn lots from

studying the dinosaurs' vanished way of life.

Bitcoin & Gresham's Law - The Economic Inevitability

of Collapse; Philipp Güring & Ian Grigg (2011).

Bitcoin & Gresham's Law - The Economic Inevitability

of Collapse; Philipp Güring & Ian Grigg (2011).